|

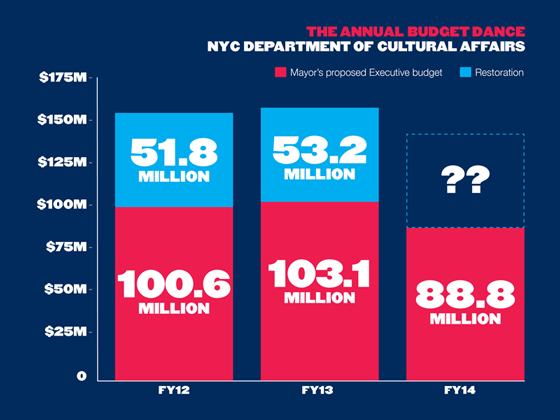

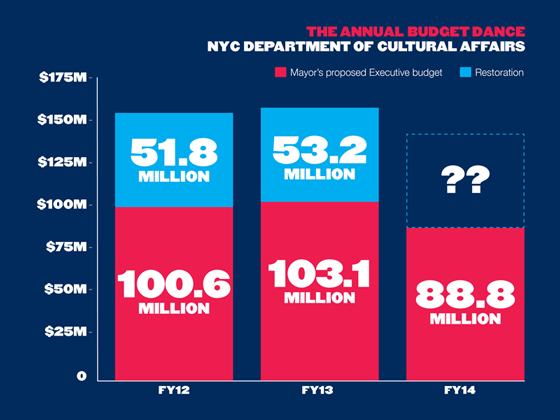

NYC Department of Cultural Affairs Fiscal Year 2014 Budget Restoration |

As you know, July 1, 2013 marked the beginning of the City's Fiscal Year 2014 (FY14). Through much of the spring, A.R.T./New York was busy advocating for full restoration to the budget of the Department of Cultural Affairs. Read the most recent testimony »

In late June, the NYC Council and Administration announced an agreement on the framework for a balanced FY14 Budget. Shortly after the agreement was announced, the City Council voted to formally adopt the City’s $70 billion FY14 Budget.

The City’s FY14 Adopted Budget includes $156.5 million for the NYC Department of Cultural Affairs (DCA), $500,000 more than was allocated to DCA in the City’s Fiscal Year 2013 Adopted Budget. Of the $156.5 million allocated to DCA in the FY14 Adopted Budget, $28.5 million will be given to recipients of DCA’s Cultural Development Fund (CDF) grants. The FY13 Adopted Budget also included approximately $28.5 million for CDF grants. However, due to mid-year budget cuts, the FY13 Budget for CDF grants was reduced to $25 million. The FY14 Adopted Budget restores this cut to CDF grants, bringing the FY14 Adopted Budget’s CDF grant allocation to the same funding level as the FY13 Adopted Budget’s CDF grant allocation.

It is important to note that although the City adopted a balanced budget for FY14, spending shortfalls are projected for future fiscal years. A $1.9 billion shortfall is projected for the City’s next fiscal year (Fiscal Year 2015) and a $1.7 billion shortfall is projected for Fiscal Year 2016.

To address these projected shortfalls, the Mayor is anticipated to require all City Agencies, including DCA, to begin planning for and implementing new budget cuts. The Mayor is expected to announce additional information regarding the new round of cuts this autumn and for cuts to be implemented in early winter. It is unclear what impact, if any these cuts will have on DCA’s Cultural Development Fund.

In addition, all City offices will be up for election in November 2013. The current Mayor and approximately 19 of the 51 current Council Members (including the Speaker of the City Council) will be term limited out of office on December 31, 2013 and are not eligible for re-election to their current offices. As a result, there will be significant changes in City leadership approximately half-way through the City’s FY14 budget. Again, it is unclear what impact, if any these changes will have on the City’s FY14 Budget or DCA.

We will continue to closely monitor the City’s Budget and will send updated information as it becomes available.

|

|

Help Prevent NYC Department of Cultural Affairs FY14 Budget Cuts |

Two weeks ago, Mayor Bloomberg released his FY14 Executive Budget, which reflected continued cuts to the Department of Cultural Affairs! If these funds are not restored, a total of $67,484,973 will be cut from the Department of Cultural Affairs (DCLA) from the adopted budget in FY13, with $23,098,123 being cut from programs. The Cultural Institutions Group stands to lose $44,386,850 in funding.

As always, we want to urge you to contact your City Council member where you live AND where you work, and ask them to restore full funding for DCLA once more. Tell them that your companies are in the schools, the senior centers, and their neighborhoods. Remind them that when the arts suffer, so do New York City's local businesses.

Help us get these valuable dollars restored! Here are ways that you can make your voice heard:

- Write or visit your City Council Member where you live and where you work and ask them to RESTORE THE FUNDING to the New York City Department of Cultural Affairs! I cannot emphasize enough how important it is to send letters AND to make a face-to-face appearance. Ask your board members who are registered voters in New York City to visit their Council Members as well.

- Make sure that everyone who visits or writes their Council Members can share this economic impact data, prepared by A.R.T./New York:

|

New York City's 375 nonprofit theatres reach

|

8,812,360

theatergoers

|

|

Using conservative estimates, we determined the following:

|

|

|

Total amount spent at local restaurants

|

$ 154,016,940

|

|

Total amount spent on parking

|

$ 45,218,862

|

|

Total amount spent on taxi fare

|

$ 65,387,711

|

|

Total amount spent on subway fare

|

$ 44,061,800

|

|

Grand total contributed to City's economy annually

by NYC nonprofit theatres

|

$ 308,685,313

|

- If you have a vendor (printer, graphic designer, restaurant owner) who is willing to write a letter or attend a visit with you to your Council Member, please have them do so! Their support carries tremendous weight because they reinforce our message that the arts are a vital part of New York City's economy, and these cuts would be devastating.

- Do you have a story to tell about how your company has worked in the community? Do you have a particularly great partnership with a local business? We want to hear about it! Email your stories to [email protected].

We cannot afford to sit this one out and hope that other groups will do our work for us. We need a strong showing of letters and visits to Council Members.

There will be a joint hearing of the Committee on Cultural Affairs, Libraries and International Intergroup Relations (along with the Finance Committee and the Select Committee on Libraries) on Monday, June 3 at 10:00am. Please note that the public will not be able to testify at the June 3 hearing before the Committee on Cultural Affairs. Libraries will testify that day at 10:00am and then Commissioner Levin is scheduled to testify at 11:30am. The public will be allowed to testify on June 5 at 3:30pm after the Department of Finance, the Comptroller, and the Independent Budget Office testify starting at 1:00pm. Last year it was nearly impossible to get inside the building to testify. For this reason, we are urging members to mail prepared testimony to City Council Finance Committee Chair Domenic Recchia, 250 Broadway, Suite 1785, New York, NY 10007.

If you have any questions, feel free to contact Executive Director Ginny Louloudes at (212) 244-6667 ext. 228 or [email protected].

|

|

|

The Patient Protection and Affordable Care Act Explained |

There is an incredible amount of information floating around regarding the Health Care ruling passed down by the Supreme Court in June 2012. We compiled the best resources we had found in to a single resource for quick and easy answers to questions.

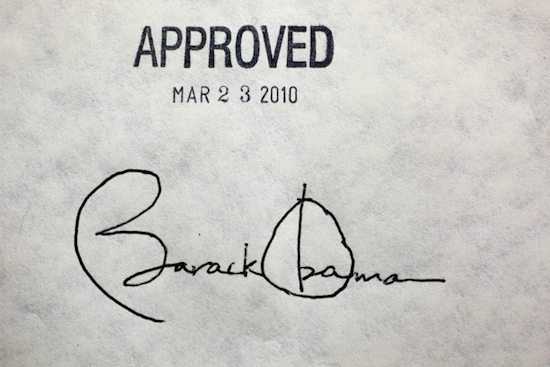

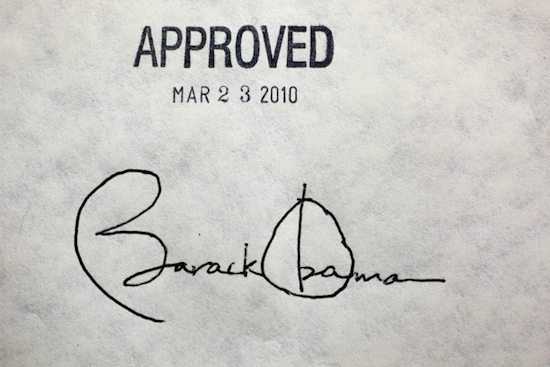

The official name is the Patient Protection and Affordable Care Act, but it will be hereafter referred to as the ACA. The bill was signed in to law on March 23, 2010, and is halfway through its four-year “roll out” period. The roll out period is a comprehensive four-year schedule of when certain aspects of the bill are put in to effect. You can view this timeline at www.healthcare.gov/law/timeline. The ACA contains nine titles (or chapters), each addressing a major area of reform:

- Quality, Affordable Care for All Americans

- The Role of Public Programs

- Improving the Quality and Efficiency of Health Care

- Prevention of Chronic Disease and Improving Public Health

- Health Care Workforce

- Transparency and Program Integrity

- Improving Access to Innovative Medical Therapies

- Community Living Assistance Services and Supports

- Revenue Provisions

To review a synopsis and key points of one of these titles, you can download a PDF summary or review key points regarding Rights and Procedures, Employers, Over Age 65, Insurance Choices and Concerns at www.healthcare.gov/law/features. Alternately, the full text of the law is available at housedocs.house.gov.

Most recently, the law was brought before the Supreme Court in order to determine whether or not it was constitutional. In a ruling at the end of June, the Supreme Court voted 5-4 that the law was constitutional, that the financial penalty on Americans that did not have health insurance should be considered a tax, and that a tax is constitutional. The only portion of the law not upheld by the Supreme Court is with regard to Medicaid and Medicare; the court ruled that the expansion of both of those programs is optional on a state-by-state basis. This means that states can or cannot implement them as they see fit. Comprehensive reporting about the rulings can be found online at nytimes.com and wsj.com.

The ACA will mean completely different for every business and for every person. To look into how it will impact you personally or in the workplace, you can refer to this online tool, which is broken down by demographic.

Whether this is a positive or negative policy is dependent entirely on who you ask. The Wall Street Journal published a feature about two entrepreneurs making the case for an opposite side. The impact will be determined entirely by a multitude of factors, including but not limited to age, state of residence, and income.

Lastly, a large part of understanding the policy is understanding the history behind it. The independent investigative journalism website, ProPublica, has compiled a reading list of relevant articles and the links to read them. They also designed a very informative flow chart, mapping the answers to the most common questions.

|

|